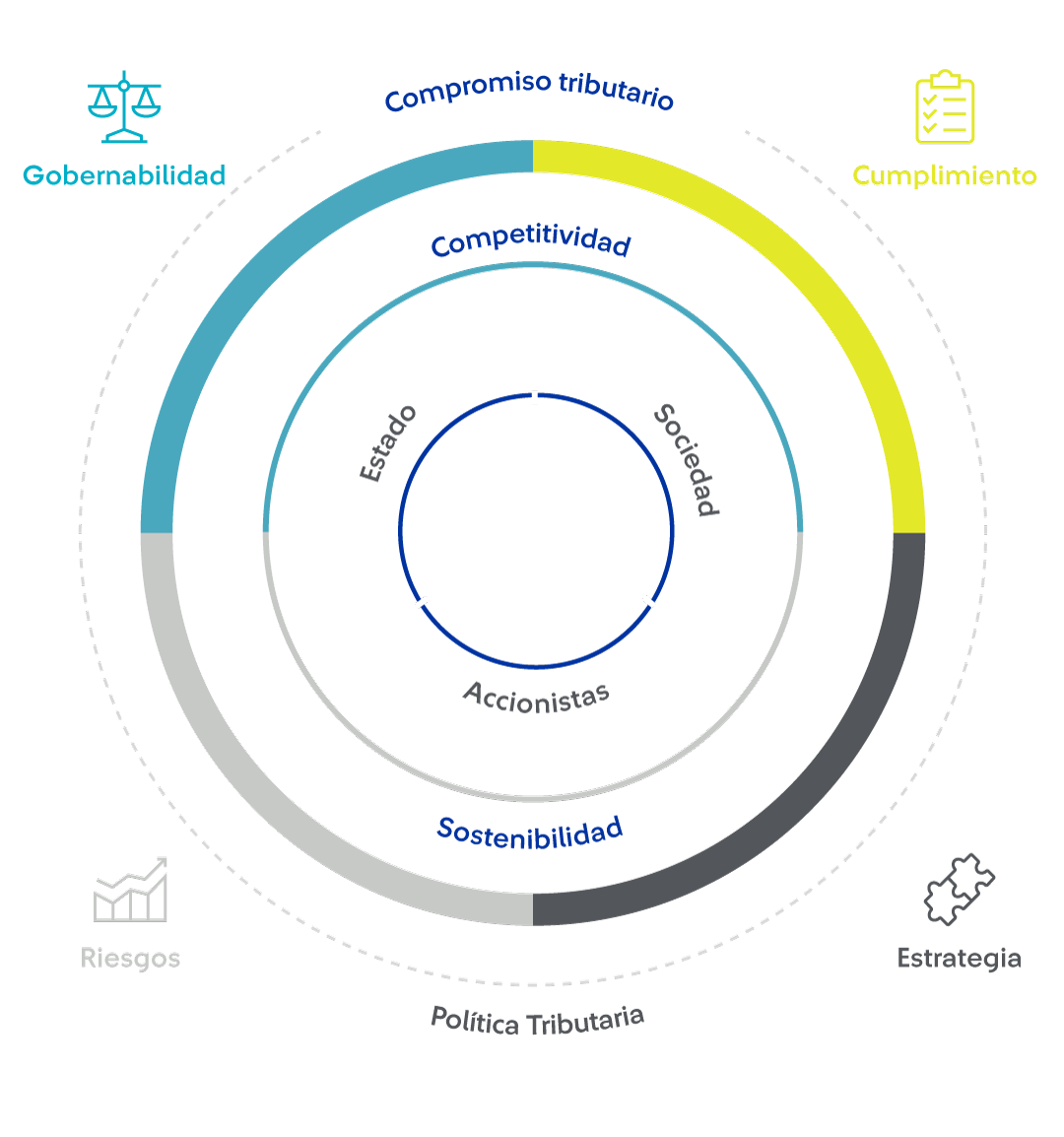

We are aware of our obligations and responsibilities

We made a commitment to the State and to a transparent business management through a framework tax policy because we are convinced that those resources will be reflected in local and regional development.

→ Tax management framework and interaction

Framework policy

Our Framework tax policy supports operations, consolidating the transparency and accountability processes with procedures that set up protocols for their management and application in our company and its affiliates.

Guidelines of the tax strategy

Relationship

Reports and disclosures

Situations for which materiality must be evaluated include:

Governance

The policy shall be approved by our Board of Directors and, after approval, it must be approved by the corporate boards of directors, and finally by the boards of directors or equivalent bodies in each of our affiliates.

The financial vice presidents or managers and tax areas in each company will ensure compliance with the laws, internal regulations, and the policy.

We and all our affiliates will be responsible for aligning any initiatives and other actions required for compliance.

Certain situations must be reported to the corporate tax areas:

English