As part of its continuous effort to provide its clients with up-to-date information on the behavior of financial markets, SURA Inversiones conducted a webinar to address the global, regional and local economic prospects, with a look at social and political developments as the COVID-19 pandemic evolves.

“As at SURA Inversiones we understand that having reliable information on what is currently happening in financial markets is essential for good investment decisions, we invited Pablo Rosselli to address this issue,” said Gerardo Ameigenda, Vice President of SURA Asset Management Uruguay, as he welcomed the speaker and the audience.

The virtual event, featuring economist and partner of EXANTE consultancy firm Pablo Rosselli, focused on whether a more favorable external scenario for Uruguay is currently consolidating, how the country’s economic activity and labor market will recover, and the wiggling spaces potentially available for national economic policy.

“There are several elements suggesting that the external context is becoming more favorable. In 2020, the formidable decline of the international situation because of COVID-19 also affected us domestically. Having said that, projections for 2021 suggest that the world economy will undergo a strong recovery. After the 3.5% fall in global GDP last year, the International Monetary Fund expects a 5.5% expansion for 2021, the most significant in 15 years,” said Rosselli, answering the first question.

Subsequently, he noted that as coronavirus vaccination rollout progresses, consumption will increase globally.

“The economy was so paralyzed that those who did not lose income managed to save, because they had no way to travel or spend on recreation,” resulting in a rise of savings rates during 2020, so “as the health situation normalizes, primarily thanks to the vaccination process, these people will spend more, thus leading to a boost in consumption.”

On the other hand, he stressed that “the expansive fiscal and monetary policies and huge fiscal momentum in the United States proposed by the new president, Joe Biden, will contribute to the global recovery.”

However, he concluded that it is premature to say that Uruguay will face an external scenario as favorable as that observed between 2009 and 2014 following the Lehman Brothers crisis: “it is too early to ensure that we are facing a new expansion cycle, because it is not yet clear whether we are facing a reacceleration of the world economy; however, we are sure we are witnessing a “rebound”.

He also explained that this year the country would show a relevant economic recovery from the average recorded in 2020, but that it would remain “moderate throughout 2021”.

“The world improved health and economics, but we need to be cautious as to the durability of these improvements, especially concerning raw materials. We are going to see more or less low interest rates, with better commodity prices for a while. Although there are doubts as to whether the dollar will continue to weaken, Biden's tax package leads us to think that it will not be the case,” he explained.

Locally, the situation reflected the international trend, with an economic decline in the first part of 2020 and a rebound in the third quarter, which presented a moderate additional recovery, albeit with sectoral nuances.

“There is a good climate of consumer confidence, allowing, for example, an increase in sales of vehicles that had fallen very sharply. In addition, exports have recovered, as well as VAT-related revenues, although the latter remains below 2019 values, because consumption is lower than that year,” he said.

The worst performance was recorded in the area “Commerce, accommodation services and food and beverage supply”, while at the other end is the “Construction” sector, owing to the boost of the UPM project.

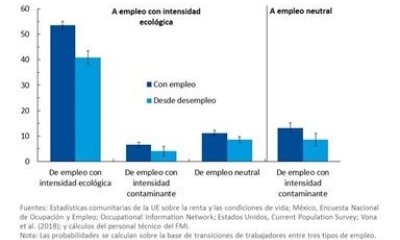

Meanwhile, the labor market maintained a slow recovery during the quarter, but the worsening of the sanitary status would have a negative impact by the end of the year and 2021, “the recovery of employment lags behind that of the economic activity,” the expert said.

Rosselli went on to explain that beyond the short-term outlook, Uruguay must continue to adjust public accounts and complete the correction of relative prices, as in his view “we are still expensive in terms of dollars”, mainly against neighboring countries. Unless we have a long-lasting commodity boom, he said, “the country will have significant growth restrictions, which call for a more important agenda of structural reforms and a decisive strategy of international insertion and capture of foreign investment”.

Finally, he made some remarks for investors, stressing that the recovery of the global economy along with low interest rates result in a favorable framework for stocks. He then pointed out that among investment banks “there seems to be some consensus” that stocks outside the United States - i.e., in Europe and emerging economies - are expected to perform relatively better.