What can the Afore industry expect for this year? Where is the sector heading in Mexico? As part of the advisory sessions titled The ABC of Afores conducted by Afore SURA, Andrés Moreno, CIO, and Gerardo Chavarría, Business Initiatives and Commercial Advisory Manager, spoke about the company's vision of the economic perspectives that will shape the Afore landscape in 2024.

What was the performance of the Afore industry in 2023?

In 2023, the market saw an erratic performance, starting the year with optimism, reversing during the second and third quarters, and closing with a renewed optimism. While in 2022 the consensus pointed to a 2023 marked by an economic recession, the strong US economy consequently surprised Mexico for the better. According to Afore SURA, although 2023 was a year marked by volatility and great challenges, the industry knew how to overcome the risks.

In terms of Afore investments, equity assets saw a remarkable performance of around 18% in USD. with a Mexican bonds yield of 6 - 9%; as a result, the funds (basic SIEFORES and Voluntary Contributions) led to a return of 8 - 10% at the end of 2023, which represents an extraordinary recovery in terms of absolute performance, as well as for some funds in relative terms to the rest of the Afores in the industry.

What is the outlook for the industry in 2024?

For Afore SURA, in general terms, 2024 seems very similar to 2023. “The economy remains strong, but growing at lower rates, which gives room for central banks to even cut their monetary policy rate and thereby generate a favorable environment for the continuity of the economic cycle. We will have to pay attention to the signals, but, in principle, that is the base scenario to be expected for continued positive returns in 2024 portfolios”, said Afore SURA.

For the company, the outlook for 2024 is positive. The increase in worker contribution rates due to the 2020 pension reform, the low level of commission rates that the system already offers, the declining inflation in Mexico and other markets in the world with potential cuts of interest rates from central banks should contribute to a positive 2024, despite the persistency of important geopolitical risks and political-economic scenarios of weight in the immediate landscape. In this sense, regarding the impact on investments that upcoming events may have, Andrés Moreno agrees that the results of the presidential elections in the United States will be one of the most important issues in the global economic landscape, as they could have the potential to bring up changes in the design of the economic policies and, therefore, in market activities. Likewise, coupled with its own presidential elections, the US outcome will have great repercussions for Mexico, because of the economic momentum of nearshoring for the country’s economy.

“Without a doubt, this is an important event to watch and be involved in the making of public policies. Today’s savings available in Afores are so relevant for the fate of our country that this opens the sector an opportunity to make proposals to improve the design of public policies regarding pensions, financing country growth, infrastructure, and other aspects that we can weigh in”, said Andrés Moreno.

As per the Pension System Reform bill proposed on February 5, 2024, this will be one more issue of public interest that will remain in sight for the rest of 2024. Afore SURA says: “We support the constitutional bills to improve the pensions of Mexicans. We will be watching to learn more about the details of the reform, especially the plans to fund this important commitment from the government.”

How is Afore SURA preparing to face these challenges?

According to Gerardo Chavarría and Andrés Moreno, Afore SURA works through global diversification to find the best investment opportunities in the market, with the support of a team of more than 60 investment experts specialized in managing portfolio risks, designing legal structures, mitigating risks, and enhancing the returns of clients at the time of their retirement.

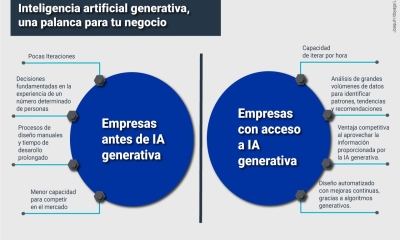

“At Afore SURA, we have a global investment diversification mandate that seeks to protect our clients' assets from economic fluctuations. We understand that diversification must respond to the risk factors of our portfolio as the stages of the economic cycle change and new ones are incorporated, that is, secular themes we must seize to invest, that in the US have to do with AI, in Mexico with nearshoring and in the rest of the world with climate change financing”, said Moreno.

In 2024, Afore SURA’s goal is to continue with the right investment and risk management in a volatile environment amidst geopolitical and economic uncertainty; as well as to encourage people to act today to improve their pension and foster a better ownership of their retirement savings through actions like updating personal data and promoting tools like the Ruta de la Pensión SURA, which is used by over 2.7 million people since its creation, with an outreach to the more than 73 million Social Security number holders.

If you wish to listen to the full broadcast Visión Financiera 2024: Navegando el Futuro de las Afores and learn more, please click here.

Press Contact:

SURA AM México

Jacqueline Briones

[email protected]

CarralSierra

Lucía Jiménez

[email protected]